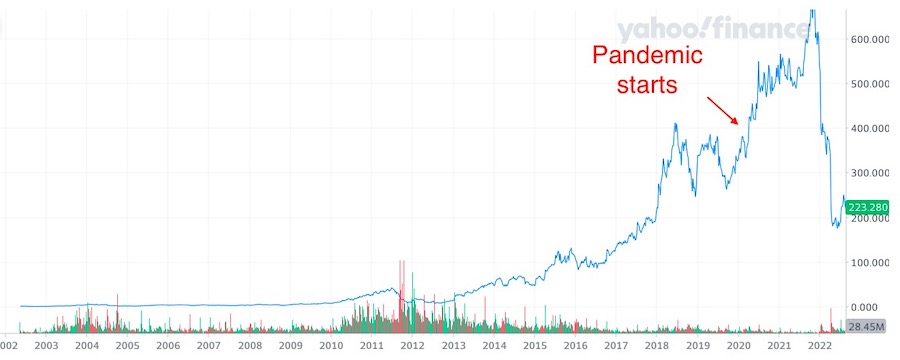

Netflix has experienced a meteoric rise since its founding in 1997 as a DVD rental service, evolving into a global streaming powerhouse. The company’s pivot to online streaming in the mid-2000s revolutionized the entertainment industry, offering a vast library of content accessible anytime, anywhere. This shift propelled Netflix’s subscriber base and revenue to unprecedented levels, attracting millions of users worldwide. Consequently, its stock price surged, reflecting investor confidence in its disruptive business model and original content strategy.

1997

- Founded

2002

- (29 May) Goes public at $15 per share (Chart: split adjusted price ≈ $1.20)

- The company is not profitable

2003

- The company makes its first profit

Assuming you bought the stock at the end of 2003 for $1.50 :

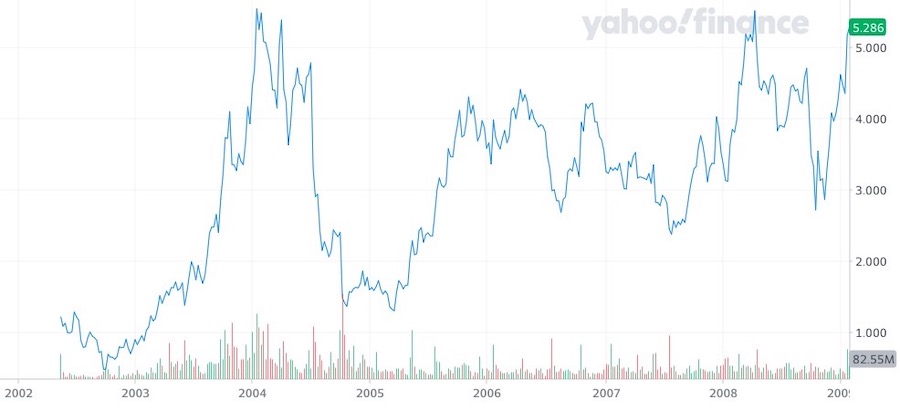

– by 2008 (5 years – assuming $4), your gain would have been 3x

– by 2013 (10 years – assuming $30), your gain would have been 20x

– by 2018 (15 years – assuming $300), your gain would have been 200x

( – by 2023 (20 years – assuming $300), your gain would have been 200x)

2004

- Competitor Blockbuster introduces it DVD online rental service

2007

- (January) Neflix launches streaming video

2009

- (June) Neflix Originals is launched

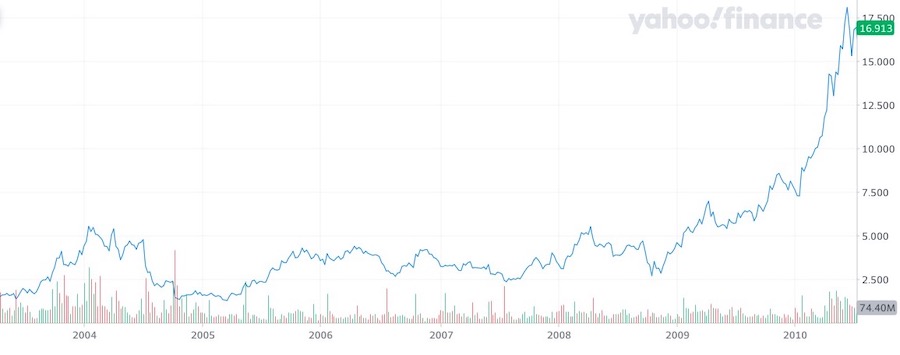

- (Early 2009) Stock starts upward trend

Assuming you bought the stock at the end of 2009 for $7.50 :

– by 2014 (5 years – assuming $50), your gain would have been 7x

– by 2019 (10 years – assuming $300), your gain would have been 40x

( – by 2023 (20 years – assuming $300), your gain would have been 40x)

2011

- (July) Neflix increases prices

- (Late July / early August) Stock starts to plunge

2013

- (February) Netflix starts streaming its first original content: House of Cards

- (Early 2013) Stock starts new upward trend

2020

- Pandemic starts in the West